12 Common Candlestick Patterns Used to Identify Simple Entry Points for Profit

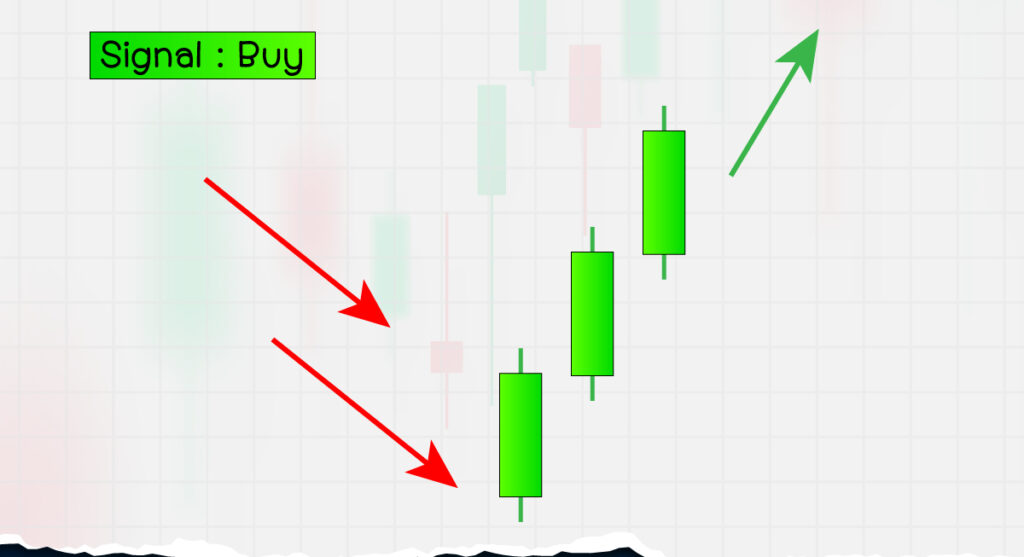

1.Three White Soldiers

The Three White Soldiers is a candlestick reversal pattern that signals a shift from a downtrend to an uptrend. It consists of three consecutive bullish candlesticks, each with progressively higher opening and closing prices. These candles form a sequence with small wicks and shadows, indicating strong buying pressure.

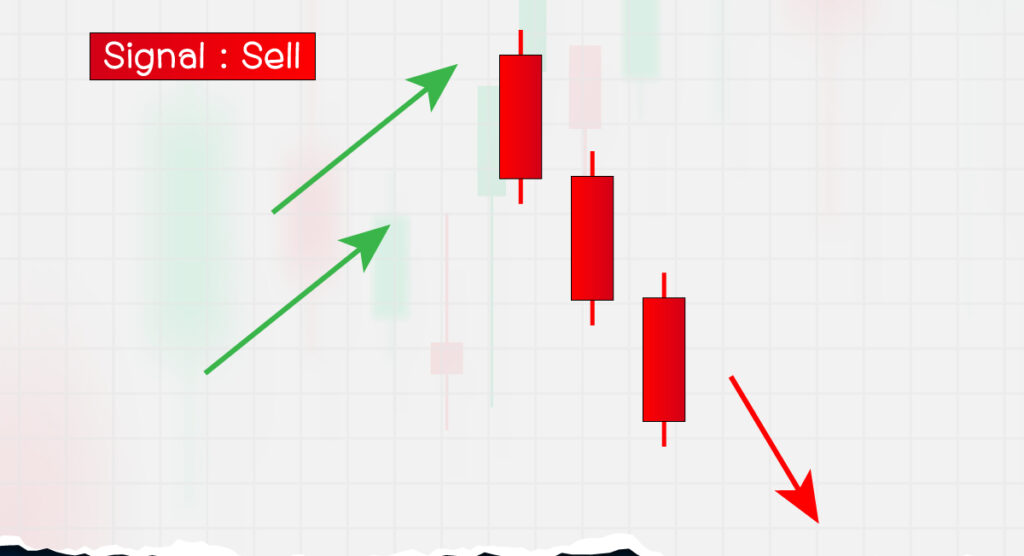

2.Three Black Crows

Three Black Crows is a candlestick reversal pattern that signals a shift from an uptrend to a downtrend. It consists of three consecutive bearish candlesticks, each with progressively lower opening and closing prices. These candles form a sequence with small wicks and shadows, indicating strong selling pressure.

3.Rising Window

Rising Window is a candlestick pattern consisting of two bullish candles with a gap between them. It typically occurs when there is high buying volatility in the market, causing the previous candle’s closing price and the next candle’s opening price to not connect. This gap indicates a rapid increase in buying pressure.

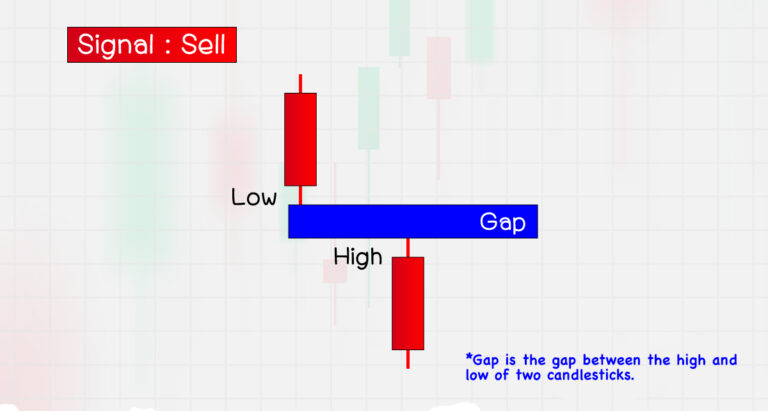

4.Falling Window

Falling Window is a candlestick pattern consisting of two bearish candles with a gap between them. It typically occurs when there is high selling volatility in the market, causing the closing price of the previous candle and the opening price of the next candle to be disconnected. This gap indicates a rapid increase in selling pressure.

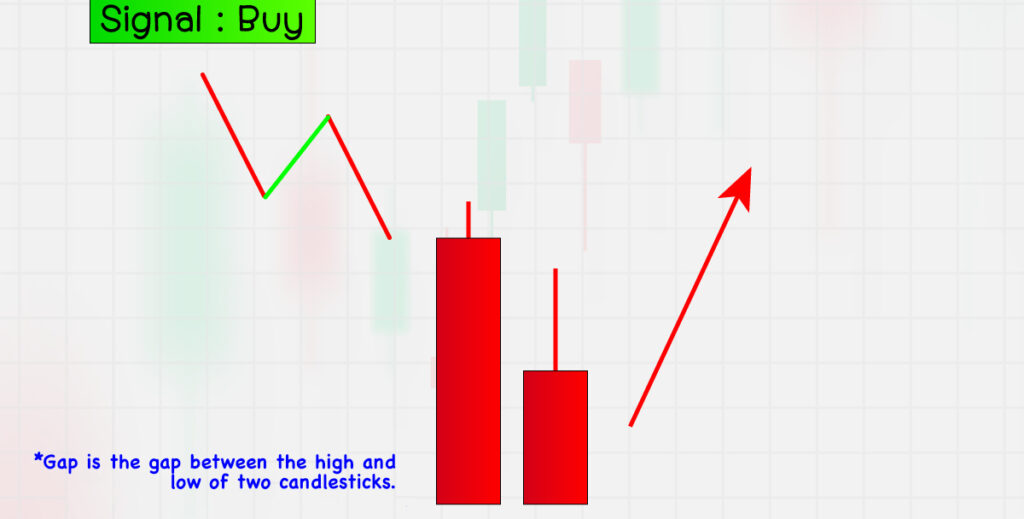

5.Bullish Belt Hold : Buy

Bullish Belt Hold is a candlestick pattern that begins with three consecutive bearish candles, each closing lower than the previous one. Following this, a bullish candle forms with a gap down that creates a new low, but buyers push the price up to close within the range of the previous candle. This indicates a sudden surge in buying pressure and suggests a potential bullish reversal in the market.

6.Bearish Belt Hold : Sell

Bearish Belt Hold is a candlestick pattern that begins with three consecutive bullish candles, each closing higher than the previous one. This is followed by a bearish candle that opens with a gap up, creating a new high, but then sellers push the price down to close within the range of the previous candle. This indicates a sudden increase in selling pressure and suggests a potential bearish reversal in the market.

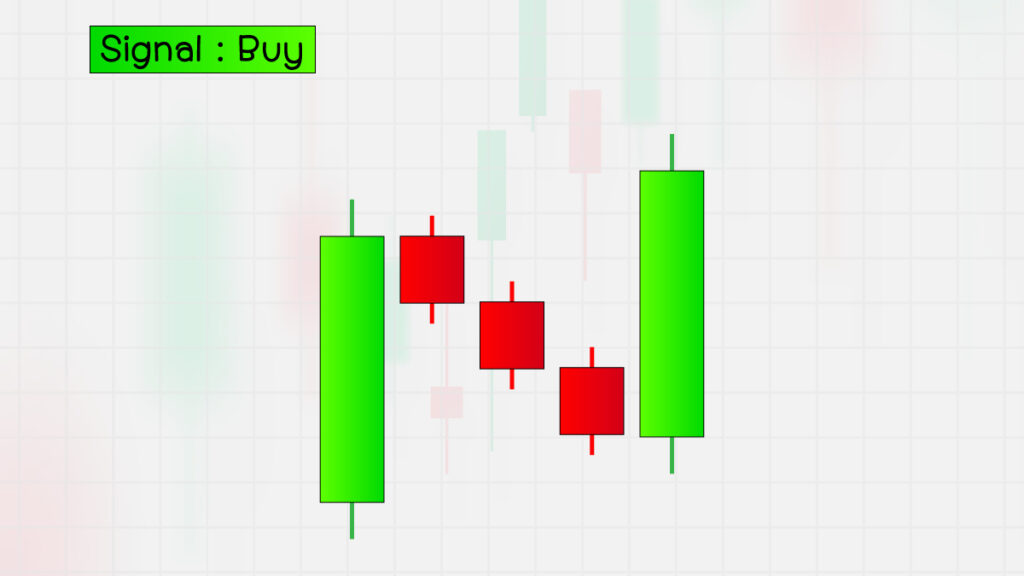

7.Rising three methods

Rising Three Methods is a bullish candlestick pattern consisting of five candles on a price chart. It typically appears during an uptrend and is used to indicate that the upward trend is likely to continue.

8.Falling three methods

Falling Three Methods is a bearish candlestick pattern consisting of five candles on a price chart. It usually occurs during a downtrend and is used to indicate that the downward trend is likely to continue.

9.Matching low

Matching Low is a bullish reversal candlestick pattern consisting of two bearish candles with the same closing price and no lower shadows. The second candle opens with a gap down from the first candle’s close.

10.Matching high

Matching High is a bearish reversal candlestick pattern consisting of two bullish candles with the same closing price and no upper shadows. The second candle opens with a gap up from the first candle’s close.

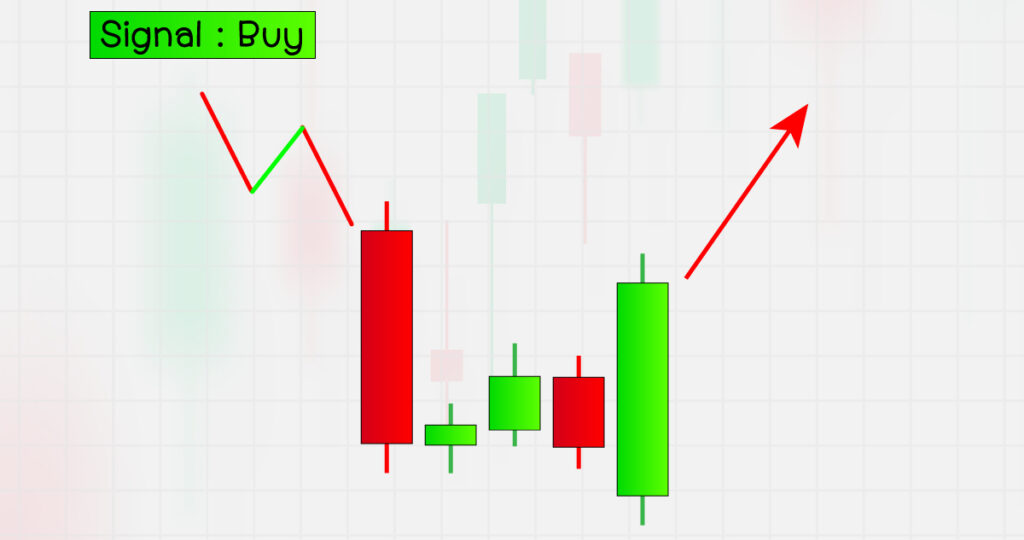

11.Tower bottom

Tower Bottom is a candlestick pattern that signals a reversal from a downtrend to an uptrend. It consists of a large bearish candle followed by three to five small candles, and then a large bullish candle.

12.Advance Block

Advance Block is a bearish reversal candlestick pattern consisting of three consecutive bullish candles that gradually decrease in size, indicating a decline in buying volume.