The journey of gold.

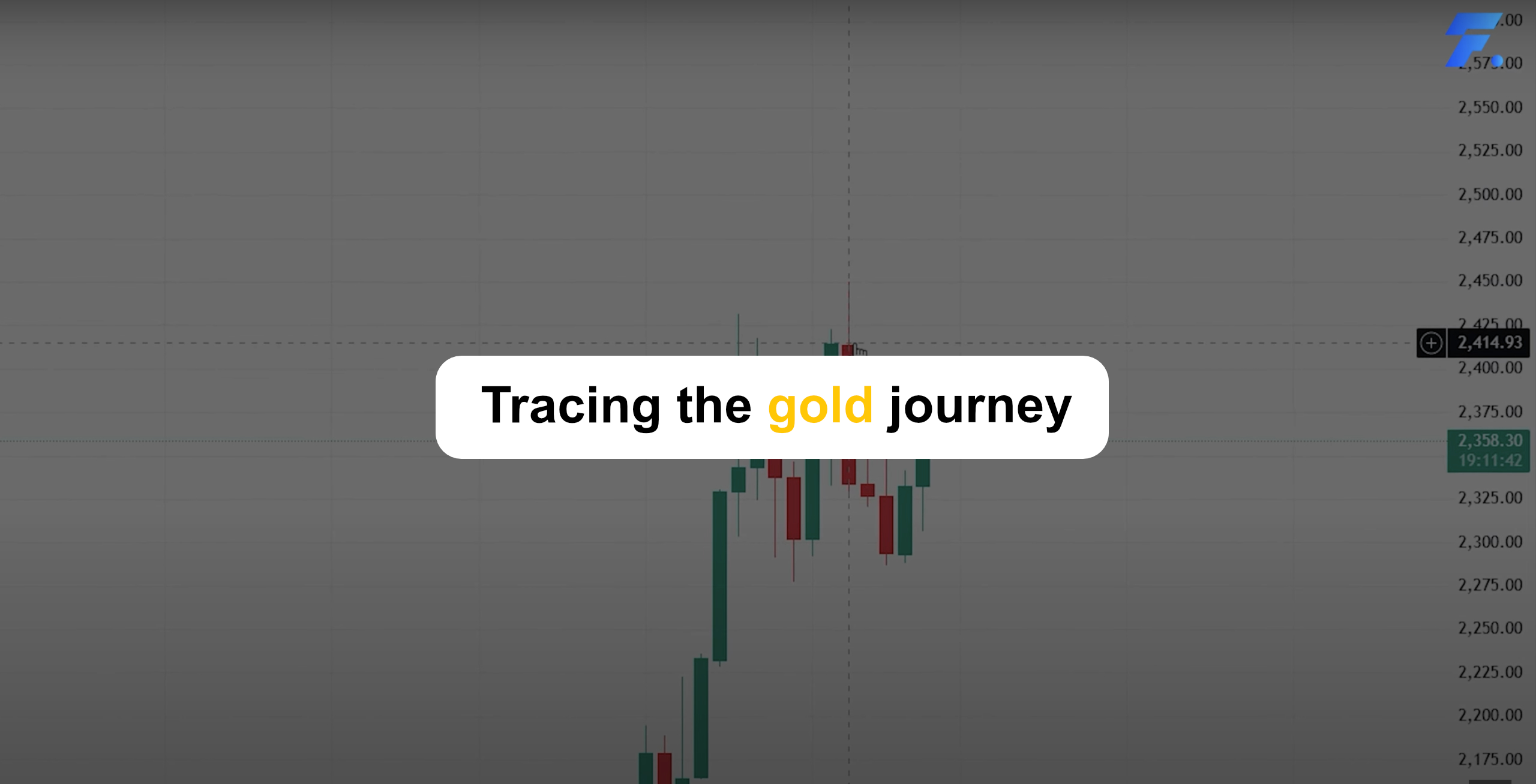

Today, let’s take a look back at the journey of gold before it reached its current price of over \$2,400 — the highest level it has ever achieved. Some even call this the third era of gold. This has made many traders and investors concerned about whether we might be heading into another bubble burst. If that really happens, it could result in long-term losses for nearly 20 years, and potentially bring our investments back into a difficult period once again.

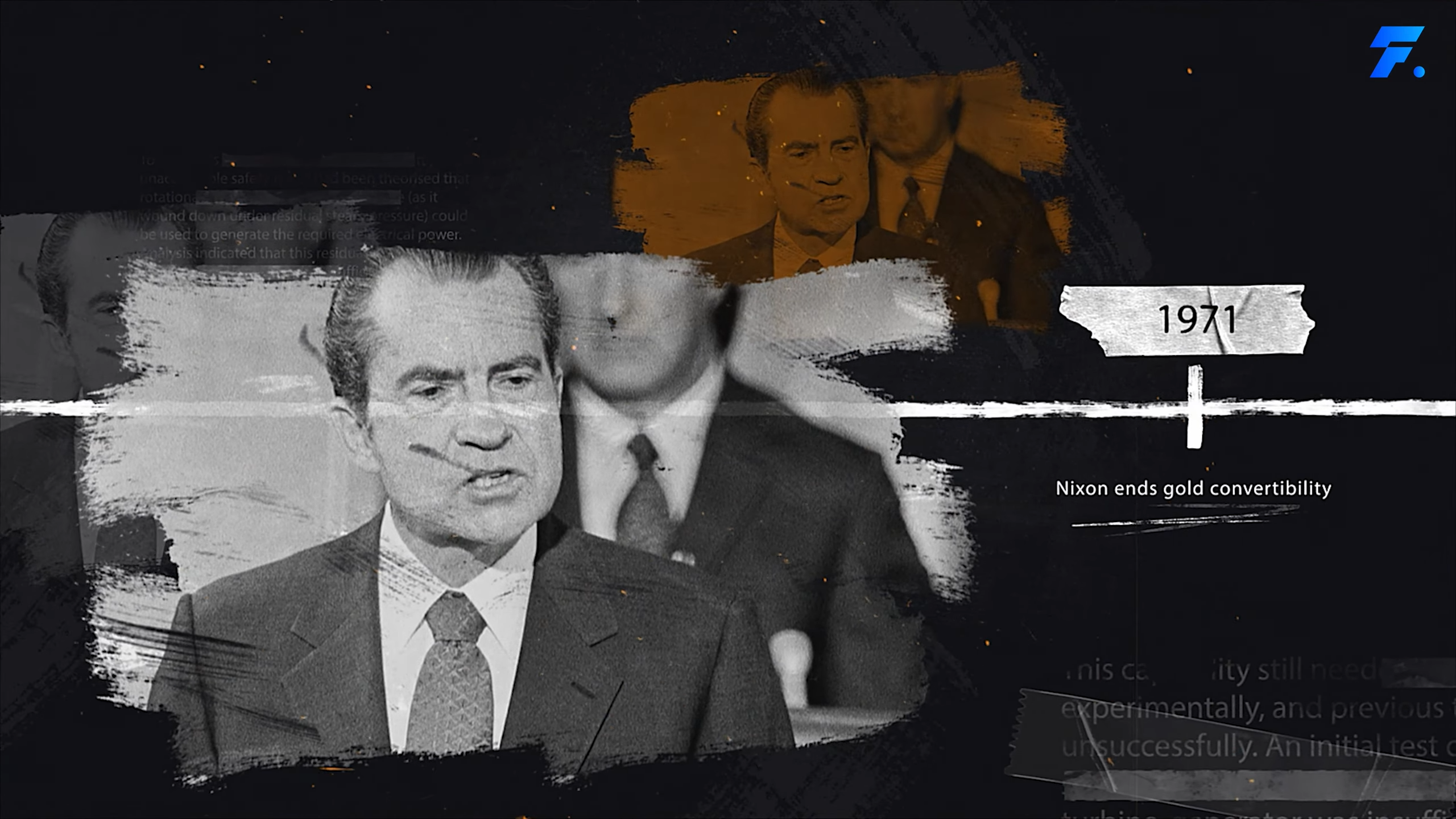

The first era of gold dates back to 1971, which was when the Gold Standard system ended. To put it simply, the Gold Standard was an international monetary system that tied the value of currencies to gold.

Era 1: The Beginning, 1970 - 1980

The first era of gold goes back to 1971, which marked the end of the Gold Standard system. Simply put, the Gold Standard was an international monetary system that tied currencies to the value of gold.

At that time, U.S. President Richard Nixon announced the end of the gold peg at a rate of \$35 per ounce. After that, gold prices surged dramatically due to several oil price crises, which impacted the global economy. The repeated spikes in oil prices pushed gold prices higher as well. However, it all ended with a crisis.

The bubble burst in 1980 marked the first era when gold prices soared, which was the very beginning of gold’s rise.

Era 2: The Similar Yet Different Period (1980 - 2011)

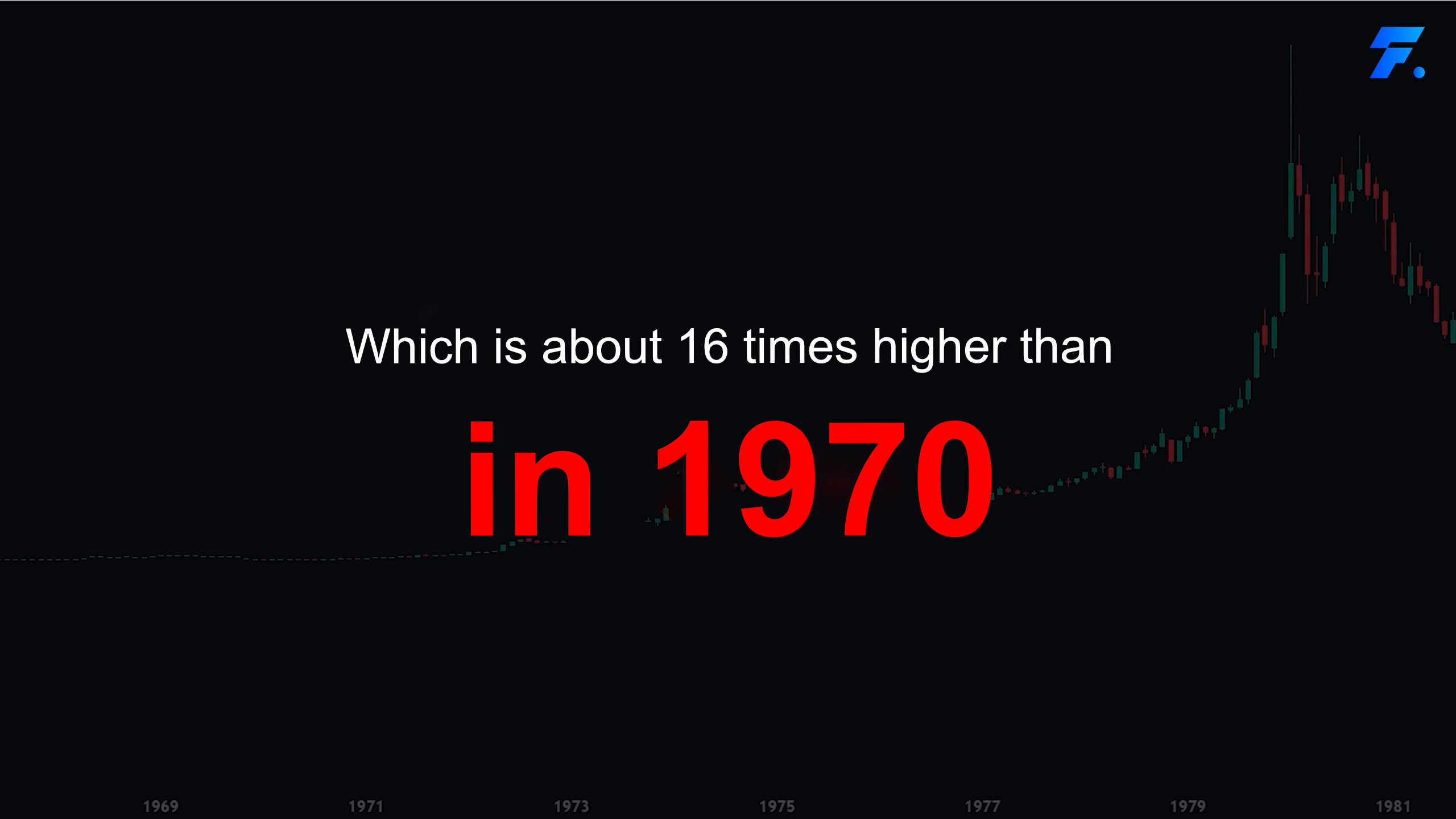

After gold prices surged rapidly during the 1970s and peaked in 1980 — reaching a level approximately 16 times higher than in 1970 — the first 20 days of 1980 saw another sharp rise of 52%, pushing the price up to a peak of \$850 per ounce.

Before experiencing a sharp and continuous decline that lasted until the year 2000, gold had gone through a 10-year uptrend followed by a 20-year downtrend. However, between 1999 and 2011, gold prices steadily increased over an 11-year period, rising by approximately 6.3 times. This marked the second era in which gold reached significant highs, drawing more attention and interest from investors than ever before.

Era 3: The Golden Boom Era (2015 – Present)

Next comes the third era, starting from 2015, when gold prices began to rise sharply up until the present. The price of gold has increased by 107% over a span of 89 months. This surge was driven by several major events that impacted the global economy, including the U.S.-China trade war, the COVID-19 crisis, the Russia-Ukraine war, and most recently, signals from the Federal Reserve to slow down interest rate hikes, along with the conflict between Israel and Iran.

This makes it difficult to predict when the peak of gold prices will occur. However, a key event is the Fed’s initiation of interest rate cuts, which signals the beginning of an economic downturn in this cycle. The latest news that China will temporarily halt its gold purchases might mark the highest point in gold prices ever seen.

Gold prices began to rise again around January, driven by a loss of investor confidence due to the weakening U.S. dollar. At the same time, central banks around the world were adjusting their reserve allocations, and the announcements of various wars led investors to turn to assets like Bitcoin and gold.

Looking at past cycles when the Fed started to cut interest rates, gold prices have consistently surged — regardless of whether the rate cuts came earlier or later than the signals of a recession. This marks the third era of gold, starting from 2015 to the present, during which gold has gradually continued its upward trend.

There is growing speculation that gold prices may be in a bubble. However, a sharp collapse in price is unlikely to occur easily due to several key reasons:

1.The public debt crisis in the U.S. and Europe is considered a long-term issue, which serves as a guarantee that the U.S. dollar is likely to remain weak. As a result, investing in financial markets is not very worthwhile. Naturally, during this period, many investors continue to invest in gold, which may make it difficult for gold prices to collapse.

2.Due to the public debt problem in the U.S., the government has to implement spending cuts to stimulate the economy, which causes the Federal Reserve to continue maintaining a low interest rate policy at 5.5%.

3.The World Gold Council also points out that India and China have taken on new roles in the global gold market and are becoming the leading drivers of global gold demand. Additionally, the shift of central banks worldwide from being sellers to buyers of gold has increased both demand and prices. However, with China now announcing a halt in gold purchases, gold prices may pause or stop rising for a while.

Considering the “bubble crisis,” which is a situation where prices fall and there is no remaining demand to buy, gold does not exhibit such behavior at this time. Although this occurred during the 1970s to 1980s, currently if gold prices drop, there is still significant buying pressure because globally, gold is seen as the best asset in the current economic environment. If we view a “bubble crisis” as prices rising without fundamental support, this is unlikely in this case, because the increase in gold prices is still strongly supported by underlying factors.

Many analysts have pointed out that those who still have a relatively small gold allocation in their portfolios can continue to gradually buy using the DCA (Dollar-Cost Averaging) method.

In summary, the likelihood of gold entering a bubble burst crisis is quite low due to the current economic factors and global conflicts. These conditions are expected to have a long-lasting impact for many years. Even when prices drop, there continues to be significant buying demand, making a bubble burst crisis very unlikely during this period.