The origin of the Pareto Principle

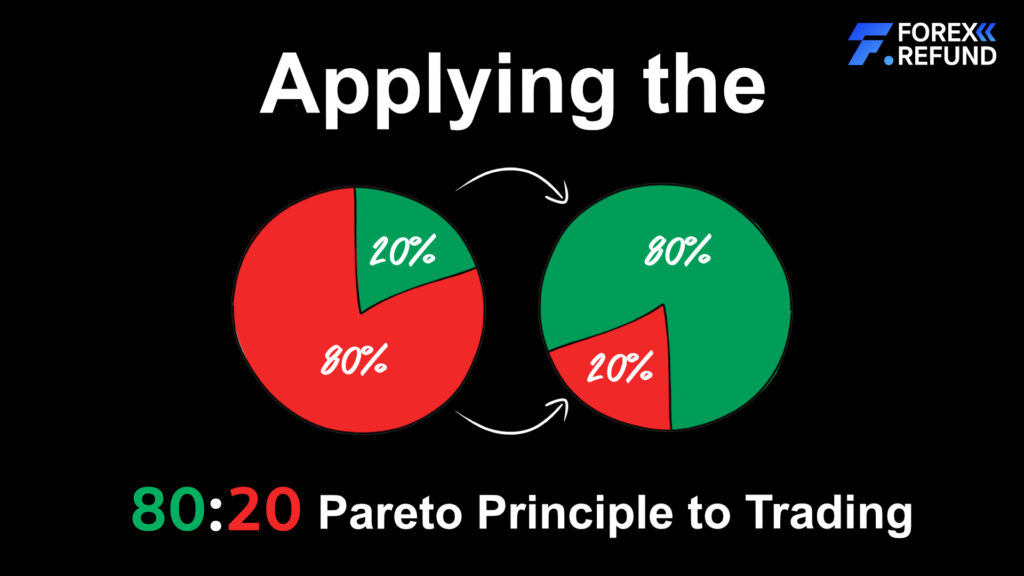

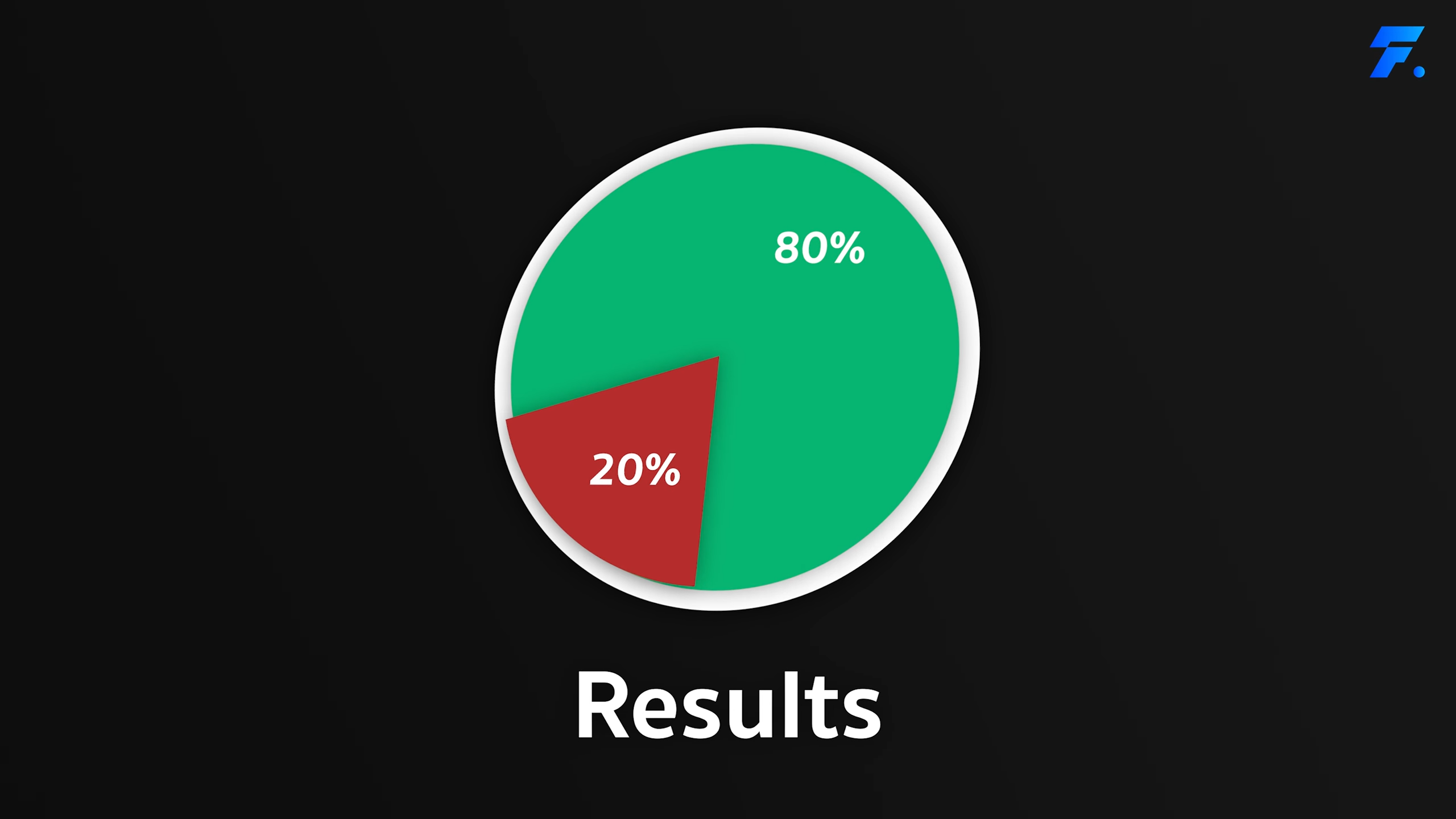

Hey friends, do you know the 80/20 rule, also called the Pareto Principle? The Pareto Principle states that 80% of the results usually come from just 20% of the causes. Simply put, doing only 20% of the actions can lead to as much as 80% of the outcomes.

The origin of the rule called Pareto dates back to 1895, when an Italian economist named Vilfredo Pareto discovered that in the environment around us—whether in nature or society—only about 20% of the factors are important, while the remaining 80% are less significant.

For example, he discovered that 80% of the economic activities and wealth ownership in Italy at that time were controlled by only 20% of the population. This led to the creation of this rule, which means that a country can progress with just 20% of its people.

For example, if we are business owners, most of the income usually comes from just 20% of our customers, while the other 80% tend to be casual or one-time buyers. In sports, only about 20% of athletes win awards. Even in the entertainment industry, only around 20% of celebrities become widely famous and well-known.

This rule can be applied universally, whether it’s about managing finances, communicating with people, taking care of yourself, eating, sleeping, exercising, or even organizing your life in a day, a week, or a month. It can also be applied to the main topic we’re discussing—trading—where the Pareto principle is equally useful.

The Pareto principle can be applied

Here’s how it can be applied: Let me start by saying, you might have seen people who work all day long but end up with very little results or output. It’s like they’re always busy but accomplish very little. This is similar to trading — just because we trade a lot or frequently doesn’t necessarily mean the results will always be good.

results will always be good.

It can be applied to trading as well. Sometimes, trading frequently doesn’t necessarily lead to better results. On the other hand, trading less often or making fewer trades might actually yield better outcomes. Even when placing multiple orders, although it can help achieve different price points, it can also be a disadvantage because it becomes harder to control risk. Placing just one or a few orders might lead to better results, such as getting a better entry point and making risk calculation easier.

Grinding away at trading all day doesn’t always mean better results. Sometimes you win some, lose some, or even end up in the red, and it wastes your time too. On the other hand, if you only trade at points where you’re confident, the results tend to be better and you save time as well. Have you ever heard the saying, “The more you rush, the slower you go”? Trying to force good results quickly can actually slow you down—this applies to everything, not just trading.

You guys can try applying this rule to yourselves. I believe it will make your trading more efficient, including improving your trading mindset. Having a clear plan in trading is very important, so I think the Pareto principle can really help you see your trading goals more clearly.

For example, you can ask yourself whether the way you are trading right now belongs to the 80% or the 20%. If it’s the 80%, try reducing your trading to just 20% of your time — that might actually bring better results than trading a lot. At least it will give you more time to focus on other things, like exercising, taking care of yourself, doing what you enjoy or love, without wasting time unnecessarily. Try applying this and see — maybe if you haven’t known about this rule before, once you learn and use it, it might suit you well.