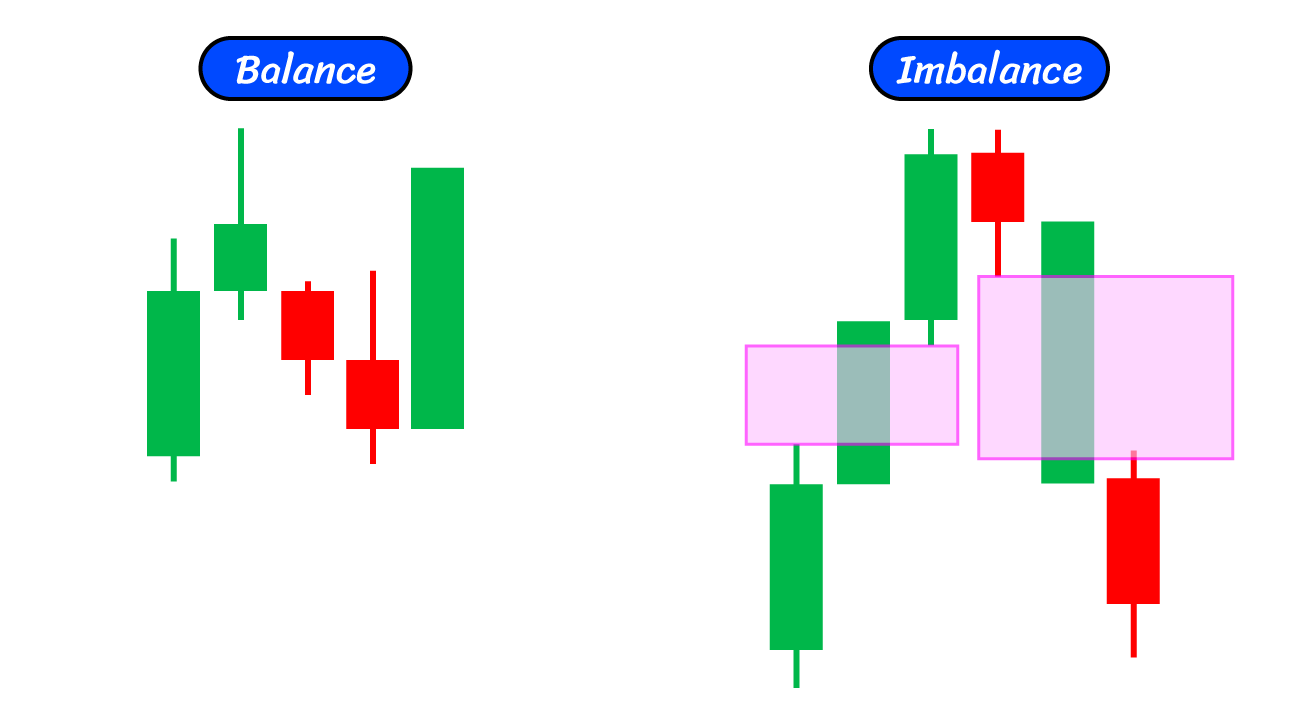

What is Balance Imbalance ?

Balance Imbalance refers to the price movement condition that indicates buying and selling pressure during that period in the market, which can be divided into a normal market condition or Balance and an abnormal market condition or Imbalance.

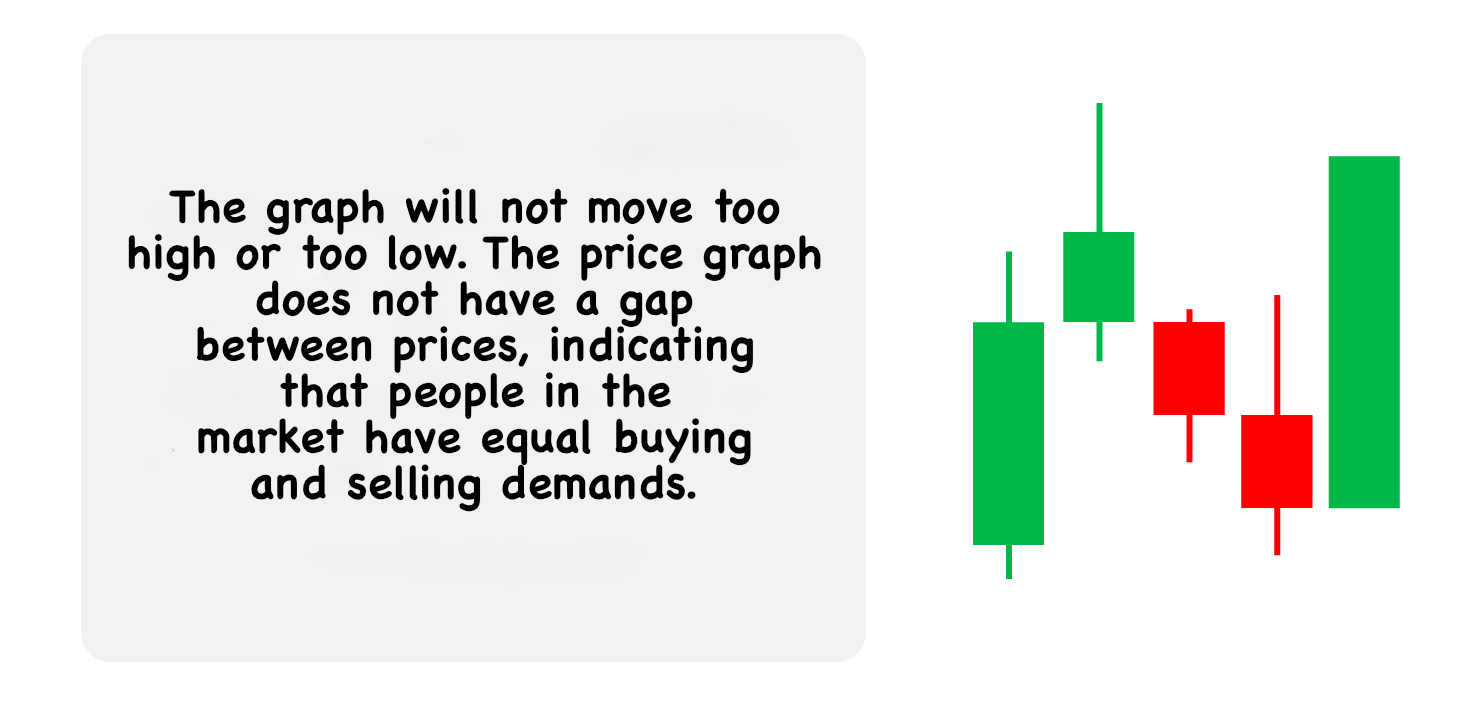

Market condition Balance

It is a market condition that is balanced or normal, meaning there is an equal amount of buying and selling pressure. The graph will not move too high or too low, and opposing candlesticks will form and close with each other, resulting in no price gaps on the graph. This indicates that people in the market have equal buying and selling demands.

Using Balance in Trading

Balance is often found during sideways market conditions, where buying and selling forces are equal, causing prices to not move in any particular direction. If you encounter a price chart in this Balance state, you might trade using various technical methods such as indicators, support and resistance techniques, or Price Action to make a profit.

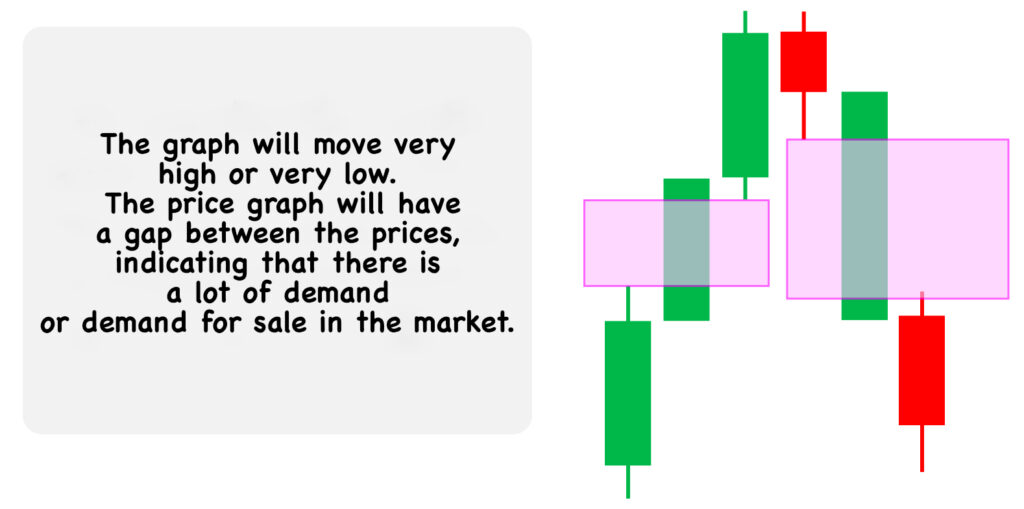

Market imbalance

It is a market condition that is unbalanced or abnormal, meaning there is an unequal force of buying and selling. The graph will show very high or very low movements, and there will be no opposing bars closing with those bars, creating price gaps on the graph. This indicates that people in the market have a high demand to buy or sell.

Using Imbalance in Trading

Imbalance is often found during trending market periods when external factors cause the graph to move abnormally, leading to one-sided trading and creating price gaps. Traders will use these gaps, characterized by long candlesticks with no other candlesticks closing within three candlesticks, to define an FVG or Fair Value Gap.

Then use the gap zone defined by the FVG frame for trading. Wait for the price to move up and touch the FVG frame before placing an order. From another perspective, using FVG is similar to trading with support and resistance levels.