What is a Breakout Trading Strategy?

Breakout trading strategy is a system where we place an order immediately when the price breaks through a support or resistance level. Normally, in regular trading, we open a Buy order to profit from a bounce when the price touches the support area, or open a Sell order to profit from a reversal when the price reaches the resistance area. However, in breakout trading, we look for strong price momentum or a strong trend that breaks through the support or resistance level, and only then do we open an order following the market momentum.

Before we go any further, let’s first understand what support and resistance levels are. This will make it much easier for us to understand how to trade breakouts.

What is a Support Level?

Support level is a line that shows the price level where the price falls to but then bounces back up, or cannot move lower than that level.

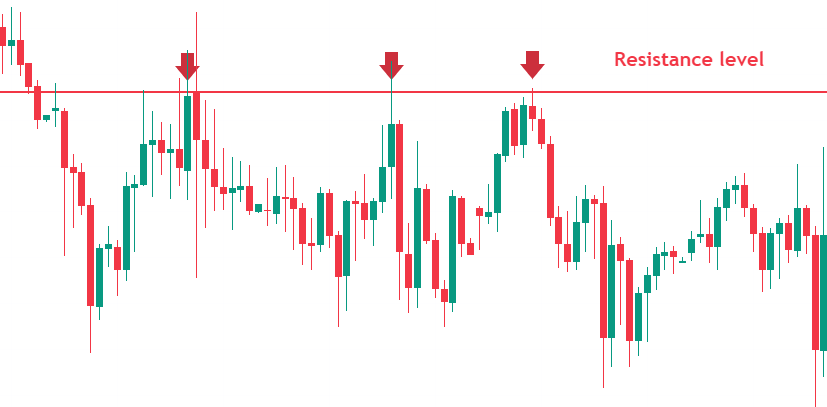

What is a Resistance Level?

Resistance level is a line that shows the price level where the price rises to, then pauses and reverses downward, or is unable to move higher beyond that point.

If we want to use a breakout trading strategy, it is important to first understand how to identify support and resistance levels. These levels are considered strong points where the price is likely to pause and reverse. However, if the price breaks through these levels, it may signal strong momentum in buy or sell orders. We can then use these points to make a profit.

How to Trade Using Breakout Trading

Breakout trading is placing an order when the price breaks through a resistance level. For many traders, a price breaking the resistance means there is strong buying momentum, so they anticipate that the price may continue to move higher. Therefore, they open a Buy order accordingly.

On the other hand, you can use the “breakout” strategy when the price breaks below the support level. For many traders, a price breaking support indicates strong selling momentum, which suggests that the price may continue to move lower. In this case, we would open a Sell order accordingly.

In this type of trading, traders may need to closely monitor price movements or place buy-stop and sell-stop orders. Usually, the stop-loss (SL) is set just above the previous resistance level or just below the previous support level.