Traders need to know 3 important patterns for finding entry points to make a profit.

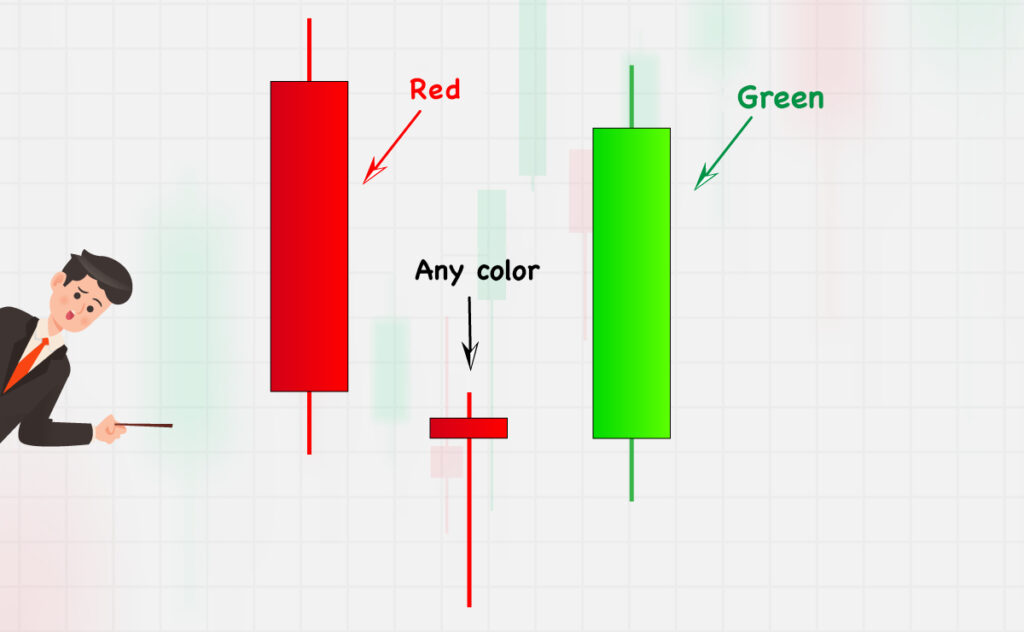

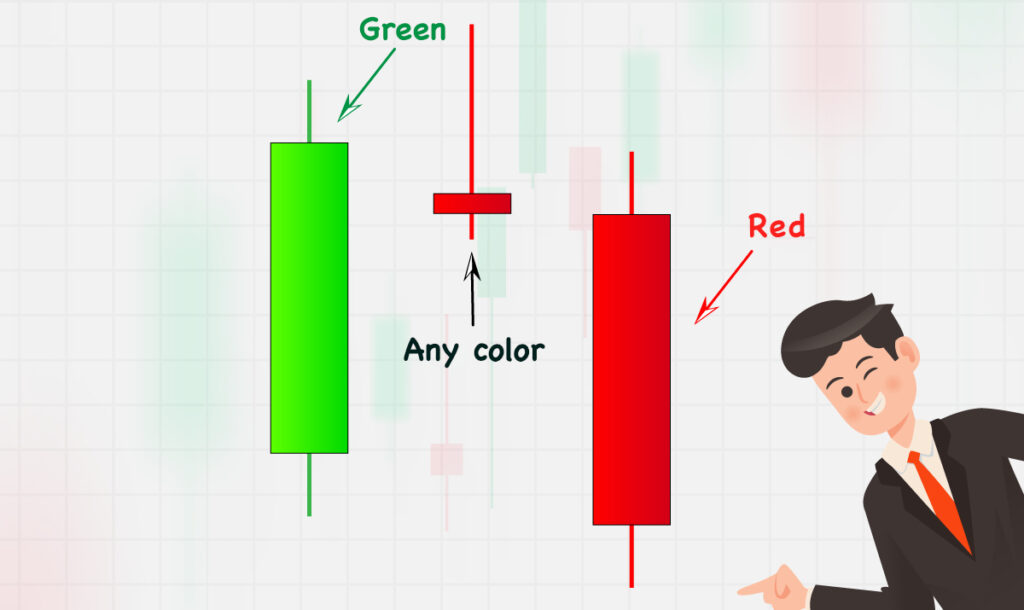

1.morning star, evening star

The Morning Star and Evening Star patterns are important formations for traders seeking relatively precise entry points. They often occur when the price chart shows a reversal.

Morning Star indicates that the downtrend is starting to lose strength and there is a possibility of a reversal from a downtrend to an uptrend.

The Evening Star indicates that the uptrend is starting to lose strength and there is a possibility of a trend reversal from bullish to bearish.

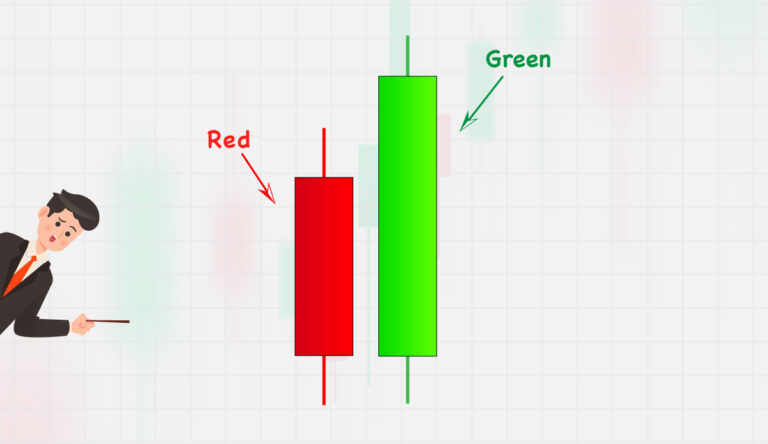

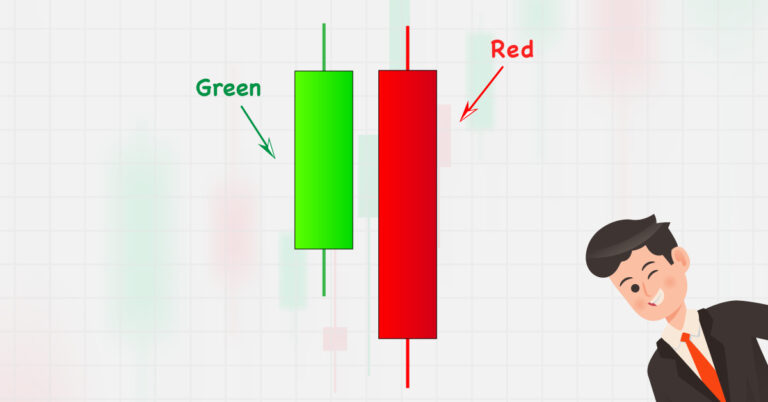

2.Engulfing

The Engulfing pattern is another important candlestick formation in technical analysis that can indicate a potential trend reversal. There are two types of Engulfing patterns.

Bullish Engulfing is a signal that indicates a trend reversal from a downtrend to an uptrend.

Bearish engulfing is a signal that indicates a price reversal from an uptrend to a downtrend.

3.Hammer/Shooting star

The Hammer and Shooting Star patterns are types of candlestick formations that can strongly indicate a potential reversal in the price chart. These patterns show that although the price may have strong momentum either upward or downward, there is ultimately opposing buying or selling pressure that pushes the price back to its original level. They often appear when the trend direction is about to change.

A Hammer indicates that the downtrend is starting to lose strength and there is a possibility of a reversal from a downtrend to an uptrend.

A shooting star indicates that the uptrend is starting to lose strength and there is a possibility of a reversal from an uptrend to a downtrend.