CCI (Commodity Channel Index)

CCI, or Commodity Channel Index, was invented and developed by Donald Lambert. Initially, Donald Lambert created the CCI to analyze commodity prices such as oil or gold only. However, the CCI proved to be very effective and widely discussed, so it was adapted for trading many other types of assets. CCI indicates the emergence of new trends and can also signal overbought and oversold conditions—meaning prices have risen or fallen too much. It is a highly versatile indicator that can be used in many different ways.

How to activate CCI

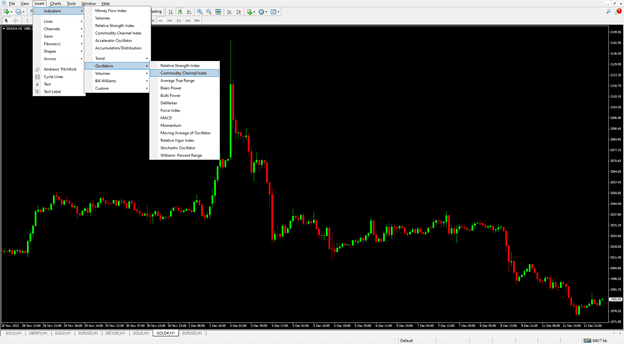

You can activate it in MT4 by going to

Insert > Indicators > Oscillators > Commodity Channel Index

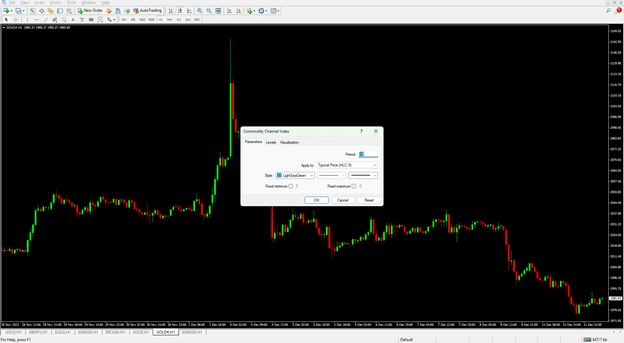

You can use the default Period setting of 14, and you can customize the color and line thickness as you like.

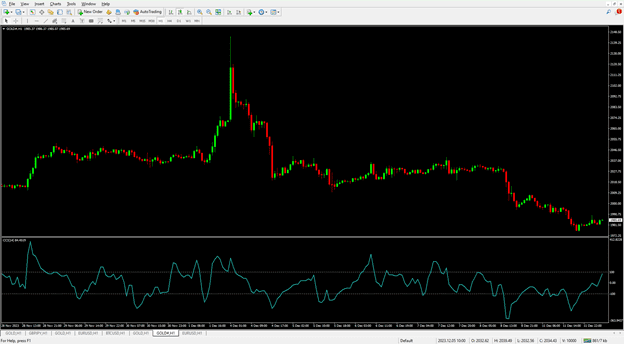

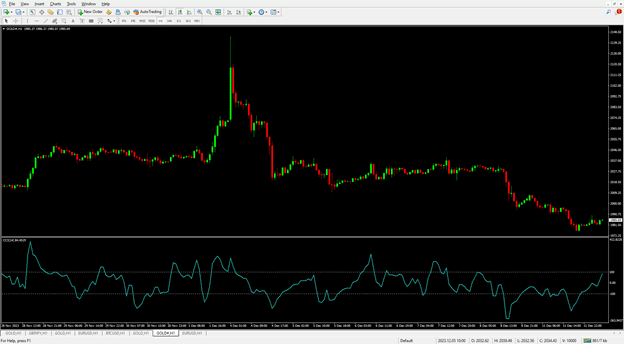

When you open the CCI, it will look like the image above. Inside the box, there are two lines: the upper line is at the value of 100, and the lower line is at -100. These two lines indicate the Overbought and Oversold zones, respectively.

How to use CCI

How to use the CCI indicator:

We look at the two lines, which are at 100 and -100. First, for the Overbought zone: if the CCI line moves above the 100 line, it means that there are many buyers in the market, or the price is in an Overbought condition. This can be a good signal that traders often use to consider opening a Sell order, because when buying pressure is high, there is a chance that the price will pull back or decline.

On the other hand, if the price falls below the -100 line, it may indicate that the price is in an Oversold condition, meaning there are many sellers in the market. Traders often use this as a signal to open a Buy order, as there is a possibility that the price will reverse and move back up.

The CCI indicator can be applied in many ways, such as assessing how strong the current trend is or using it to detect divergence. CCI is very versatile and can be used either as a main indicator or as a confirmation tool to support your trading signals. It can be used on all timeframes.