What is a Fair Value Gap (FVG)?

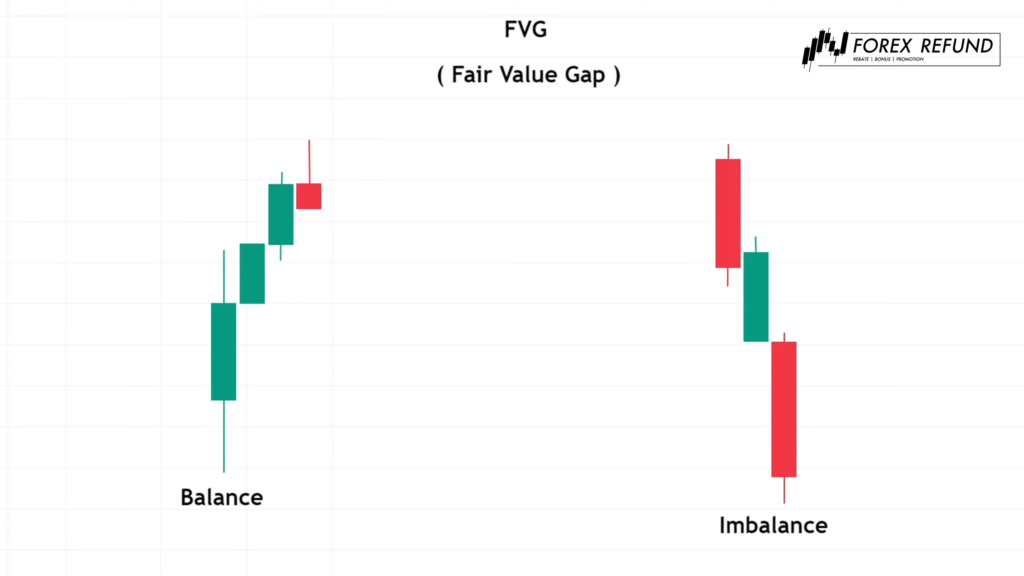

FVG, or Fair Value Gap, is a price gap caused by abnormal price volatility. Investors refer to this trading strategy as the Smart Money Concept. They predict that the FVG zone is where large investors enter the market, and due to the massive buying and selling power, the price experiences unusual volatility, creating a gap. By visually observing the price chart, this gap can be seen in both market conditions: the normal market state (Balance) and the abnormal market state (Imbalance).

The meaning of a balanced market is one where buying and selling are in equilibrium, with buying pressure and selling pressure evenly matched, resulting in no gaps. In contrast, an imbalanced market has uneven buying and selling forces, which may be caused by news or large players entering the market, leading to gaps or Fair Value Gaps (FVG) appearing on the chart.

This technique is therefore relatively unknown among beginner traders. However, for professional traders, FVG is considered a technique that can help generate profits quite easily.

How to Use Fair Value Gap (FVG)

Using FVG to find price gaps: There is no specific indicator tool for this on trading platforms, but we can use other tools to draw the FVG gap zones. For example, I use TradingView for chart analysis and utilize the Shapes tool to frame and identify the FVG zones on the chart.

How to Use Fair Value Gap (FVG) in Trading

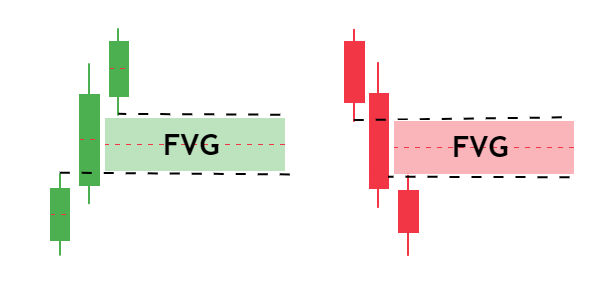

Using FVG in trading during market Imbalance conditions, when a gap appears on the price chart, traders need to observe three candlesticks where the highest or lowest prices of the first and third candlesticks do not overlap, as shown in the image.

It can occur in all market conditions, both in downtrends and uptrends. FVG works best during trending market phases.

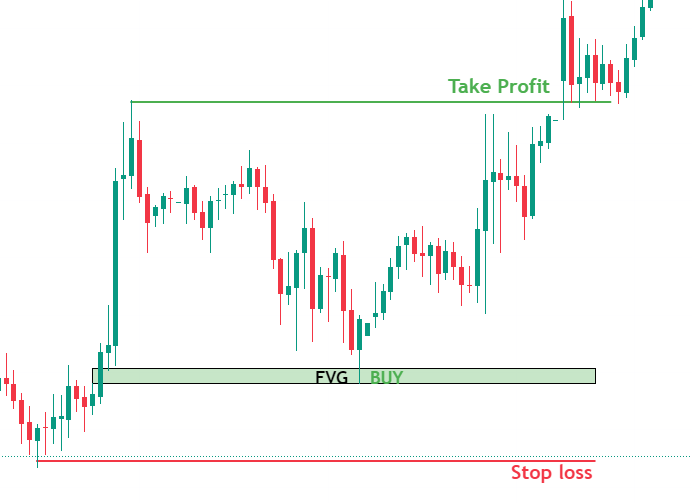

Using Fair Value Gap (FVG) in an uptrend market

We use FVG as a support zone by identifying the area where a gap occurs between candlesticks, then drawing boundary lines according to the width of the gap. This creates the FVG zone, which traders use to find entry points for profit. When the price retraces and touches the FVG zone, traders consider entering a Buy order.

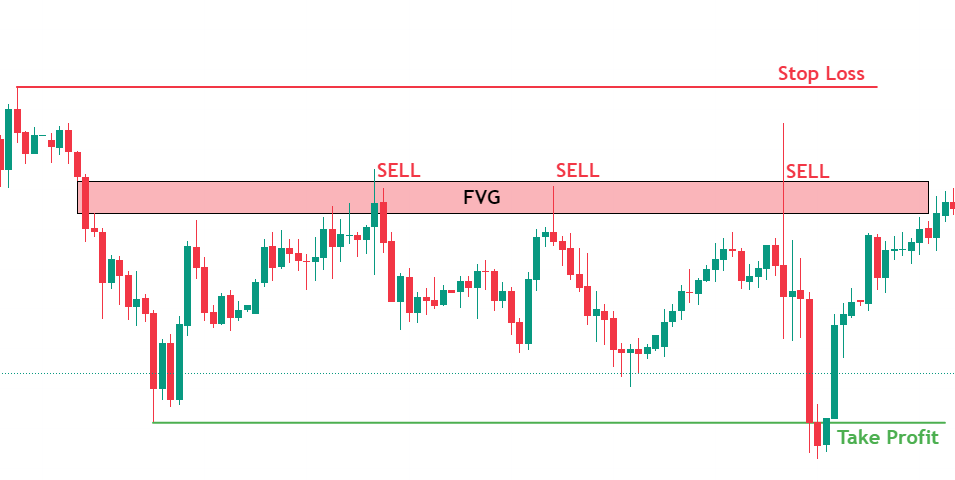

Using Fair Value Gap (FVG) in a downtrend market

We use FVG as a resistance level. First, identify the area where the candlesticks create a gap, then draw a box along the width of the gap to form the FVG zone. Traders use this zone to find entry points for profit. If the price retraces and touches the FVG zone, traders will consider entering a Sell order once the price reaches that zone.