What is liquidity?

If translated literally Liquidity refers to the market’s liquidity that arises from the demand for buying and selling, which drives the price chart to move up or down. Without liquidity in the market, prices will stagnate or not move, as we see during weekends when the market is closed.

The emergence of liquidity in the market

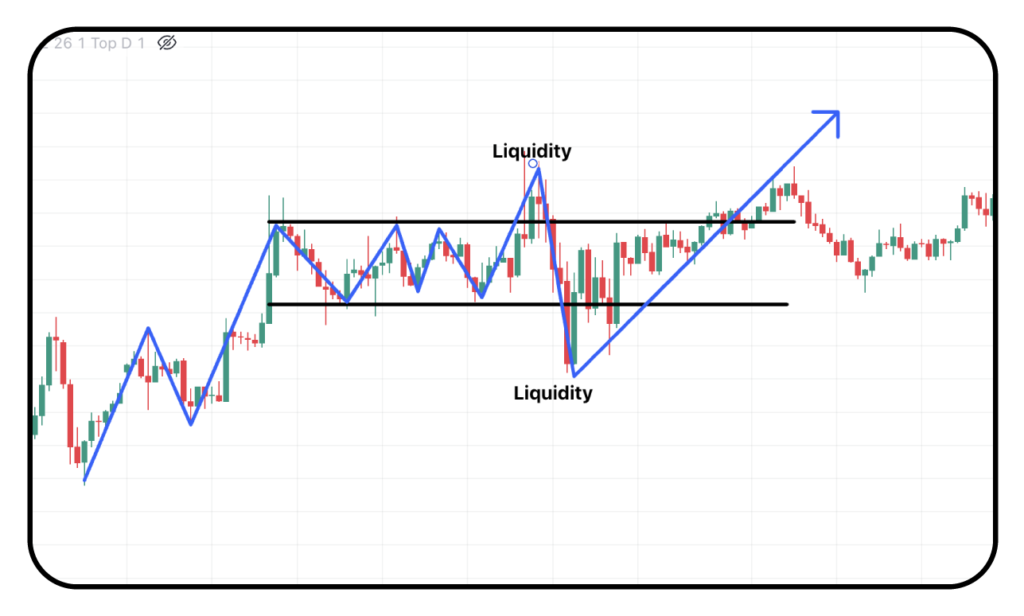

Liquidity will occur during periods when retail traders place a large number of orders. Most of these retail orders will have stop-losses or limit orders set. These orders will be countered by the market maker, who will place orders in the opposite direction of the retail traders and then return to the original direction, creating liquidity to maintain market balance.

When the graph is moving in the same direction that retail traders perceive the market to be heading, it leads to a large number of buy orders and stop-loss placements. This causes the market maker to place opposite orders to create liquidity, resulting in retail traders getting their open orders hit (retail traders getting stopped out) to generate market liquidity before the market reverses back to the original direction.

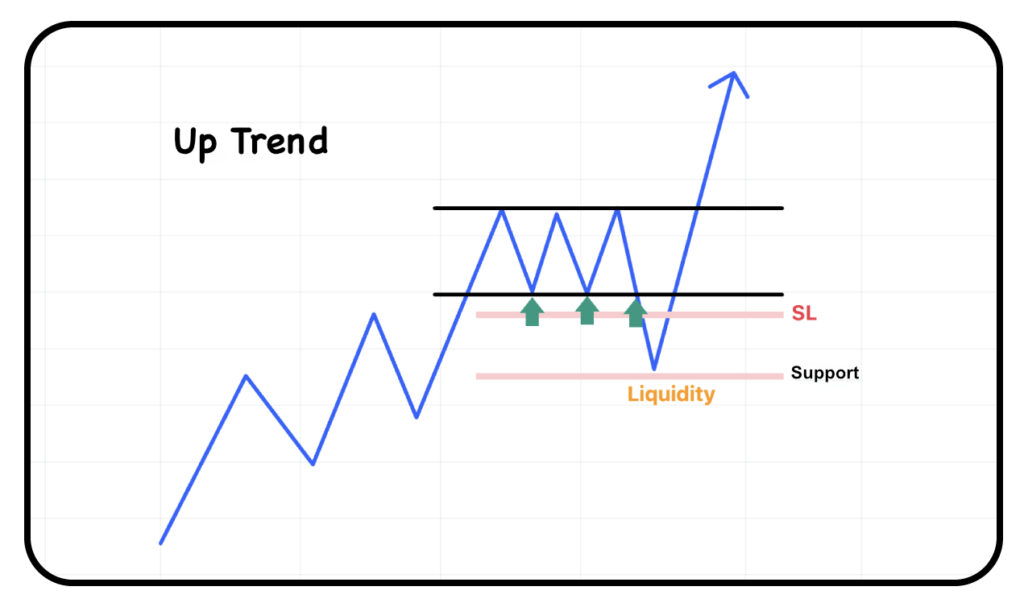

The emergence of a liquidity uptrend

In an uptrend, if the graph shows a sideways movement and suddenly starts to decline as if it were reversing into a downtrend, but then the graph shoots back up in the same direction as the uptrend, we should consider the lowest point here as liquidity and draw a significant support line. When the graph retraces to touch that support line again, there is a high chance that the graph will reverse and go up again.

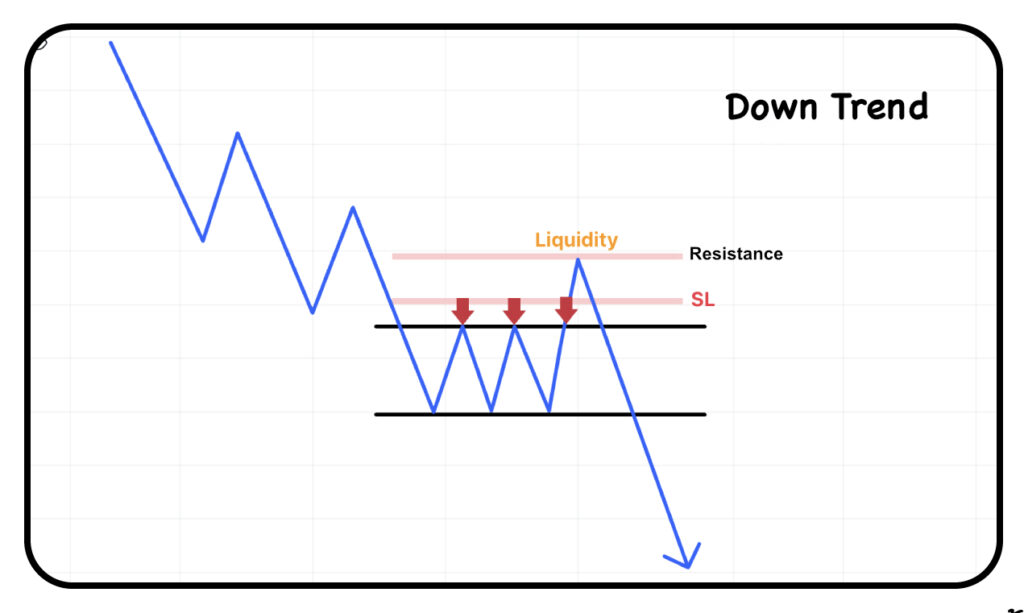

The emergence of a downward liquidity trend

In a downtrend, if the graph shows a sideways movement and then suddenly rises as if it were about to reverse into an uptrend, but then the graph falls back in the same downtrend direction, we should consider the highest point here as liquidity and draw a significant resistance line. When the graph rises again to touch that resistance line, there is a high chance that the graph will definitely reverse downwards again.

Liquidity cannot be avoided.

The occurrence of liquidity is something we cannot predict when or where it will happen, which is something all traders cannot avoid. However, the advantage is that if we understand the occurrence of liquidity, we can anticipate the behavior that will follow after liquidity occurs at that point.