What is Market Structure?

Market Structure refers to the framework of the market. This structure is very important for every trader entering the market to understand thoroughly because the market structure can indicate the current movements of the market. By understanding the market structure, we can better comprehend the behavior the market is exhibiting at any given time.

This advantage not only helps us keep up with market movements but also allows us to anticipate the future direction of the market. For traders who are new to the market, Market Structure is an essential first lesson that should be understood before entering to make a profit.

The market is divided into three trends.

Market movements can be divided into three main types, which indicate the behavior of market activity. These are an uptrend, a downtrend, and a sideways or no-trend movement.

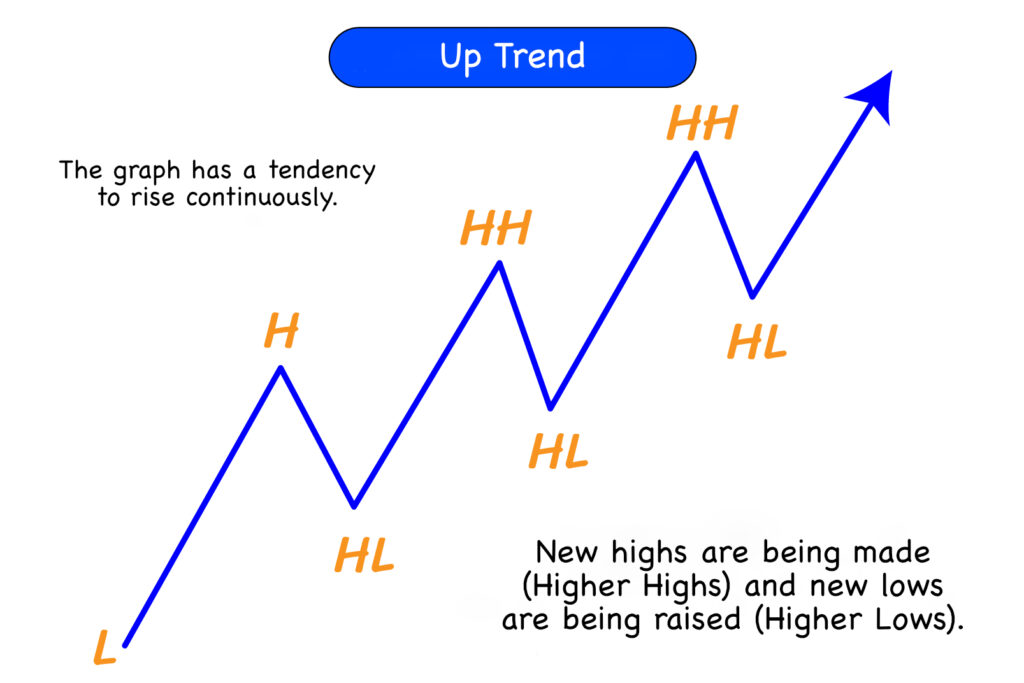

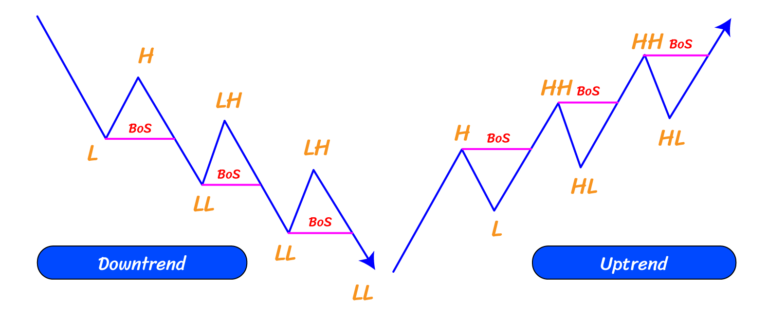

Uptrend

The characteristic of a chart in an uptrend is that the price continuously moves higher. The chart forms new higher highs and the lows also rise, creating higher lows.

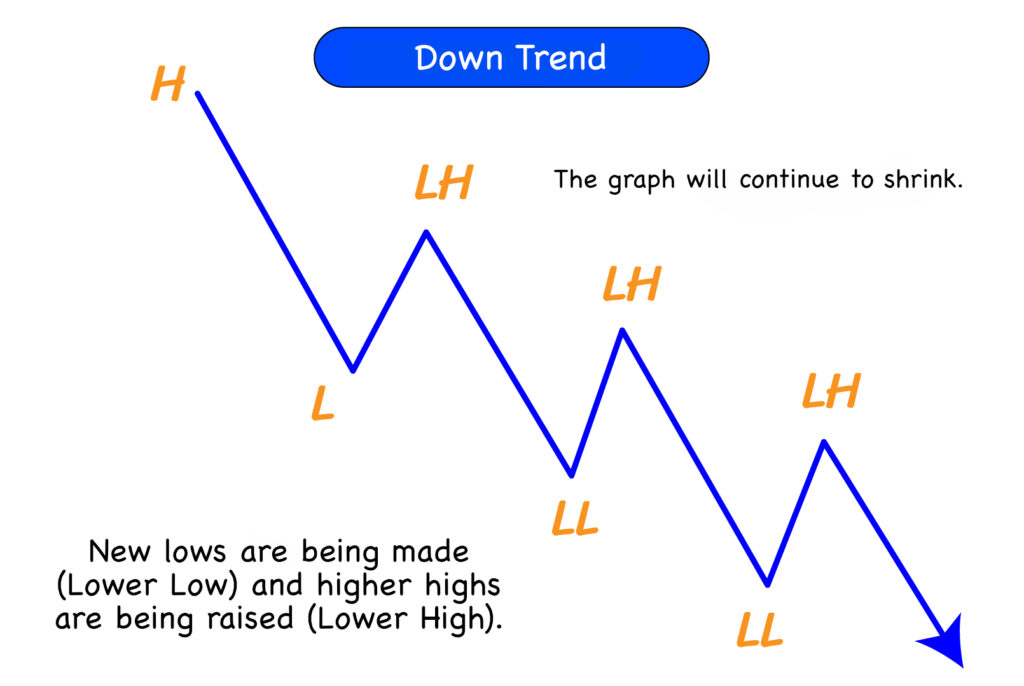

Downtrend

The characteristic of a downtrend chart is that the price continuously pulls back lower. The chart forms new lower lows consistently, and the highs are also lowered, creating lower highs.

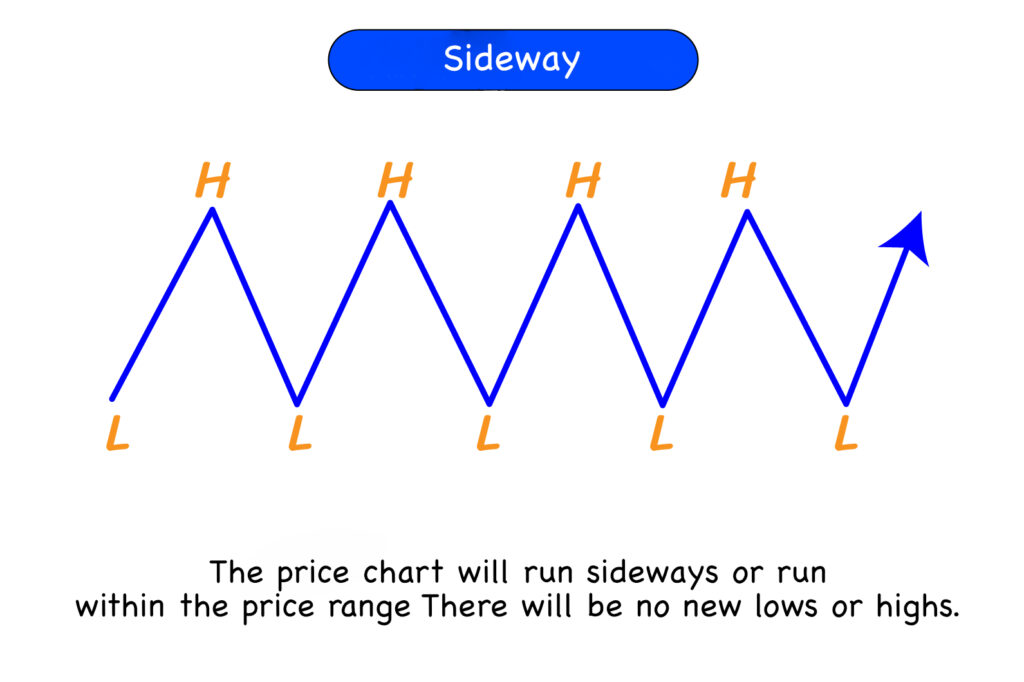

Sideway (No Trend)

The characteristic of a chart during a no-trend period is that the price moves sideways or stays within a price range without creating new lows or new highs.

Understanding the 2 behaviors of the market

After the price chart forms various trends over a period of time, the chart will show behaviors that indicate whether the trend will reverse or continue. The behaviors I’m going to talk about are BoS (Break of Structure) and CHoCH (Change of Character), which many professional traders use to communicate and analyze price chart behavior.

BoS, or Break of Structure, is a price behavior where the market breaks the existing chart structure in the direction of the current trend. This occurs when the market is trending, and the price pushes beyond the previous high or low to create a new highest high or lowest low.

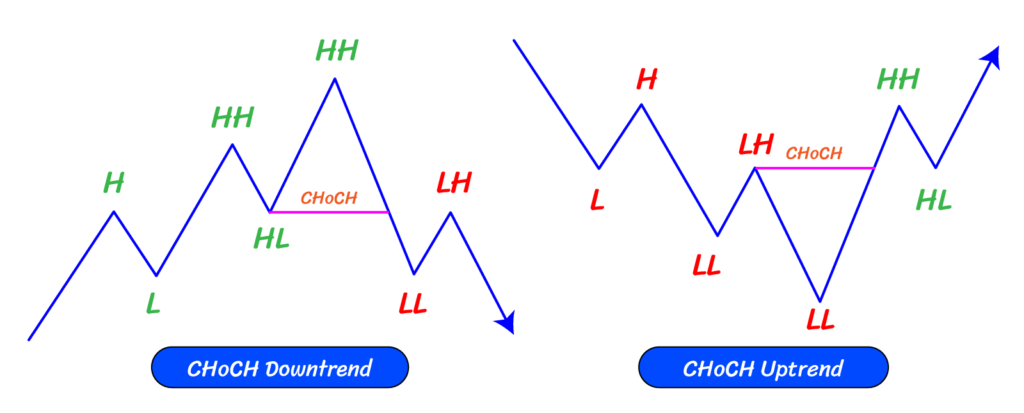

CHoCH, or Change Of Character, is also a price behavior but differs in that the chart breaks the previous structure in a new direction. This typically occurs when the market is about to reverse—from an uptrend to a downtrend or from a downtrend to an uptrend. After the price has been trending in one direction, it suddenly breaks below or above the previous trend structure, indicating a change in the market’s character.

For example, in an uptrend, the chart makes higher highs and higher lows continuously. Then, the price pulls back and creates a lower low that breaks below the previous higher low. This indicates a Change of Character (CHoCH), signaling a shift from an uptrend to a downtrend.

Understanding the primary and secondary trends to find entry points.

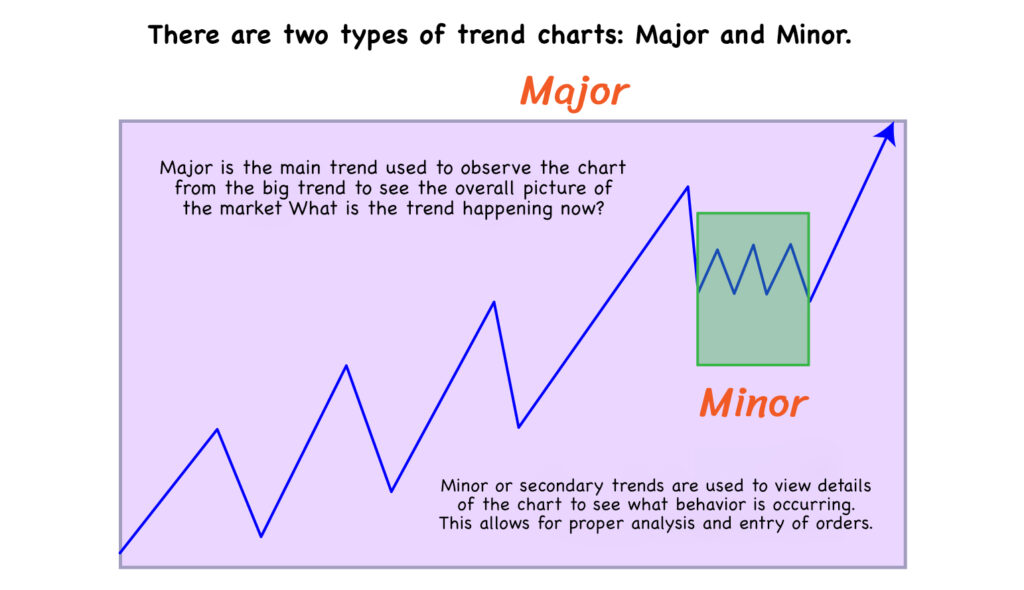

After getting to know the market structure and market behavior, the last thing I want you to know is how to classify the chart trends before trading, so you can find precise entry points. There are two types of trend classifications: major and minor.

Major refers to the primary trend that traders use to observe the overall market from the big-picture trend. It helps to understand the general market direction or trend at that moment. Once traders know the major trend, they use the minor trend, or secondary trend, to examine the finer details of the chart and understand the current price behavior. This allows traders to analyze the market and place orders more accurately.