What is an Order Block?

An Order Block is a zone where a price trend reversal occurs, potentially due to the presence of major investors, banks, or any large market participants with substantial capital. These players use their funds to defend a price level, preventing it from rising higher or falling lower. They do this by placing large buy or sell orders in the market, which can significantly impact price direction and lead to a trend reversal.

Characteristics of an Order Block

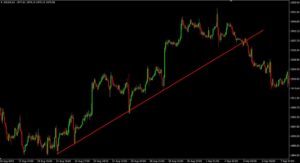

Normally, an Order Block forms at the peak of a swing, whether it’s a swing low or swing high — essentially at the point where the price changes direction. We identify the last candlestick before a strong trend reversal, then mark a zone that covers the entire body of that candlestick. This zone is then used to find potential entry points for trades.

How to Draw an Order Block Zone

We should look for a point where the price reverses, and then identify the last candlestick of that reversal. For example, if the chart forms a swing high and then reverses downward, we would use the last bullish candlestick to create the Order Block zone.

If the chart forms a Swing Low and then reverses upward, we will use the last Bearish candlestick to create the Order Block zone.

How to Trade Using Order Blocks

As previously mentioned, an Order Block is a zone where investors believe that large institutional traders have entered the market with significant capital, with the intention of preventing the price from rising any higher or falling any lower. Traders often use this area as a key point to enter trades and capitalize on potential price movements.

If the price is above the Order Block zone, we use the Order Block as support and as a point to open a Buy order.

If the price is below the Order Block zone, we use the Order Block as resistance and as a point to open a Sell order.