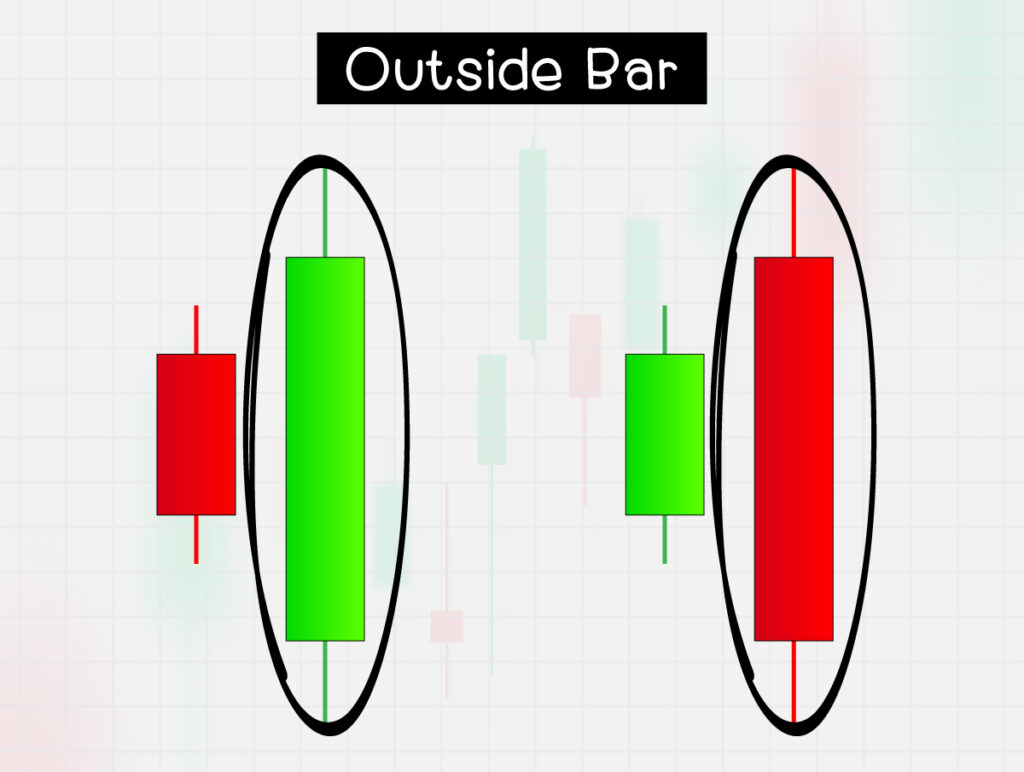

What is an Outside Bar?

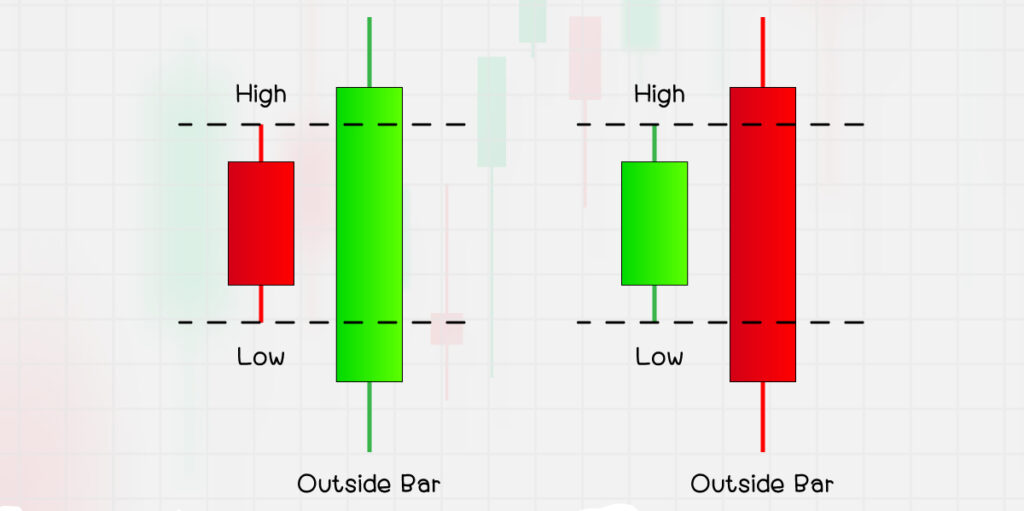

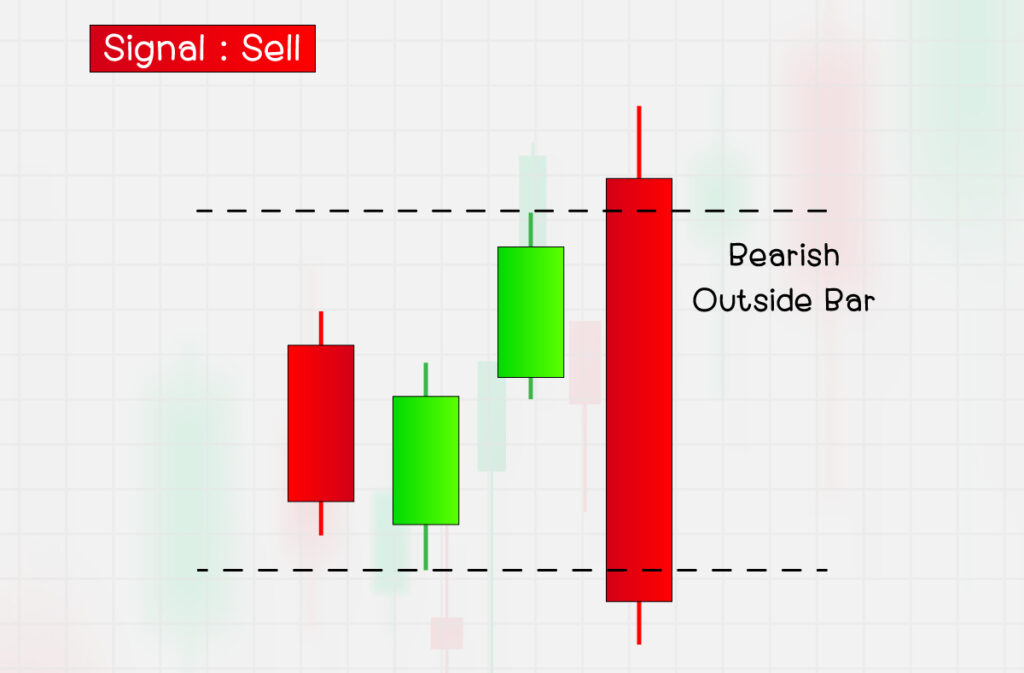

An Outside Bar is a type of price action pattern that occurs when the entire price range of a candlestick—its open and close—is longer or larger in size than the previous candlestick.

Characteristics of an Outside Bar

An Outside Bar is a large candlestick that forms immediately after a smaller candlestick. The body and wick of the Outside Bar are both larger than those of the previous candle. It’s similar to the Inside Bar pattern, except that in this case, the “Mother Bar” comes after and is referred to as the Outside Bar.

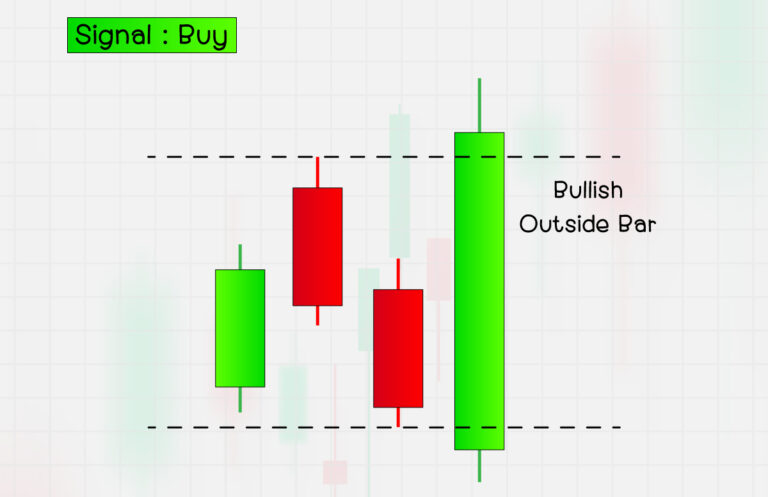

Trading using the Outside Bar.

An Outside Bar is a type of candlestick that can encompass both the highest high and the lowest low of the previous candlestick, indicating a significant increase in buying or selling volume at that moment. It suggests a potential continuation in the direction of the price movement. An Outside Bar typically forms after a small candlestick that reflects market indecision, where the price fails to clearly indicate the market’s next direction.

A Bullish Outside Bar is used as a signal to enter a Buy order when the Outside Bar closes as a green (bullish) candle.

A Sell signal is identified using a Bearish Outside Bar as a trigger to enter a Sell order when the Outside Bar closes as a red candle.