Trading Sessions

Did you know that even though the foreign exchange market is open 24 hours a day, five days a week, there are actually certain times that are more suitable for trading than others? This is because the forex market follows the opening hours of four major financial centers around the world. These sessions provide opportunities for investors to buy and sell currencies. If we choose to trade during these optimal trading sessions, we increase our chances of making profits in the market.

As we all know, the foreign exchange market consists of various currency pairs from different countries that are traded by traders and investors. That’s why trading sessions are an important topic of interest. When more participants enter the market—especially during overlapping times of major markets like the London and New York sessions—trading volume significantly increases. This means that traders can buy or sell currencies more easily, and it also leads to faster price movements and increased market volatility.

Opening hours of the four markets

So how do we know the different trading sessions and their times? Don’t worry, because this time I’m going to share the trading hours that traders should focus on in the foreign exchange market. First, we need to know how many trading sessions the forex market has and what they are.

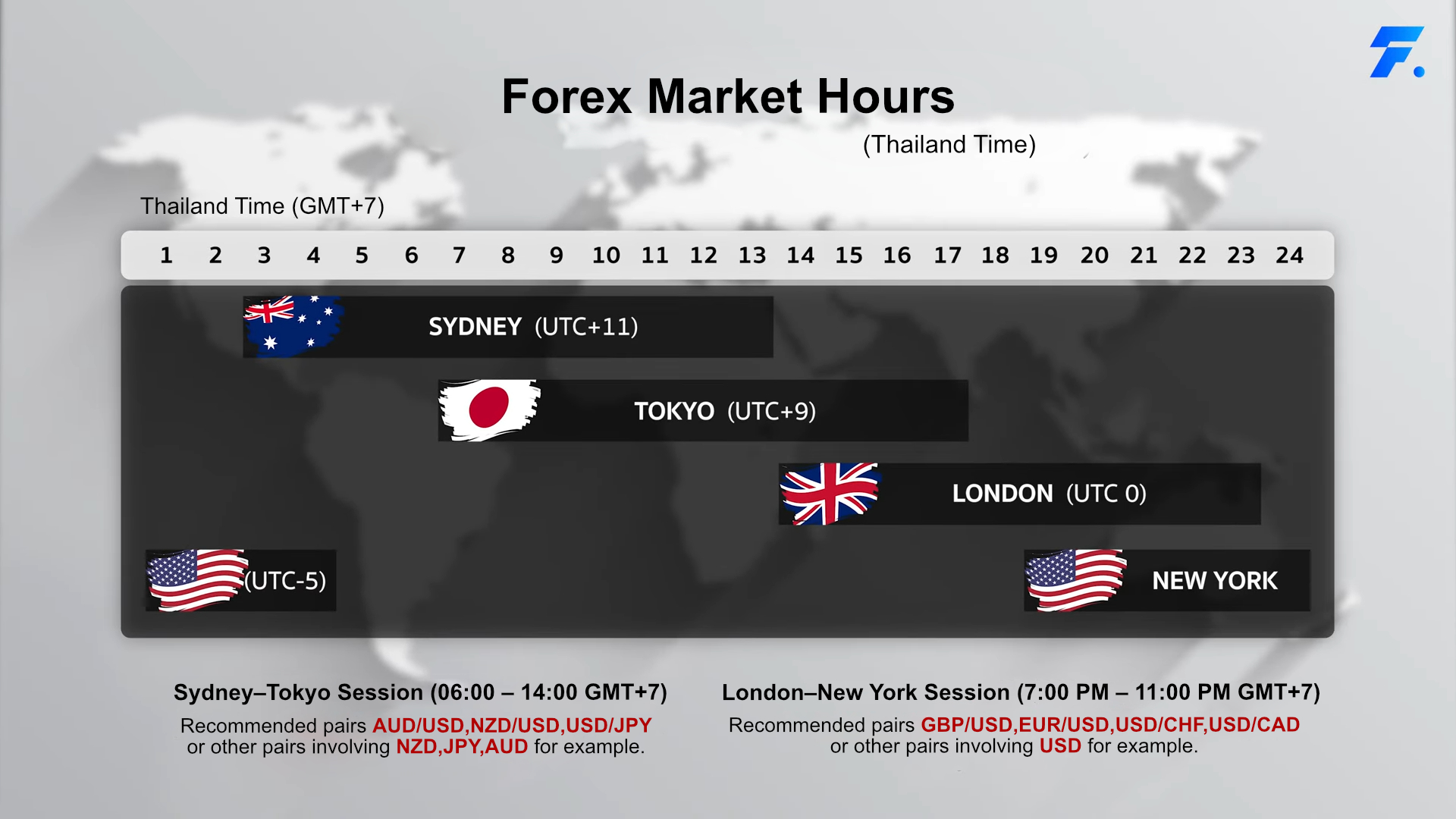

The foreign exchange market has four important trading sessions: the Sydney market, the Tokyo market, the London market, and the New York market. I have already converted the opening hours of each session into Thai local time for you.

1.The Sydney market opens from 04:00 to 13:00.

It is suitable for trading currency pairs that include AUD and NZD.

2.The Tokyo market opens from 07:00 to 16:00.

It is suitable for trading currency pairs that include JPY and NZD.

3.The London market opens from 14:00 to 23:00.

It is suitable for trading currency pairs that include GBP, EUR, and CHF.

4.The New York market opens from 19:00 to 04:00.

It is suitable for trading currency pairs that include USD, CAD, and XAU/USD.

Overlapping trading hours

The overlapping trading hours in the Forex market are important because this is when trading volume is high, causing the charts to be more volatile and offering greater profit opportunities. However, the risk also increases accordingly.

1.Sydney – Tokyo market: 06:00 AM – 2:00 PM

Currency pairs to trade include AUD/USD, NZD/USD, USD/JPY, or other pairs involving NZD, JPY, AUD, etc.

2.London – New York market: 7:00 PM – 11:00 PM

Currency pairs to trade include GBP/USD, EUR/USD, USD/CHF, USD/CAD, and other pairs involving USD. This is a highly active trading period, especially for popular pairs like gold (XAU/USD).

You can see that each major currency has different opening and closing times, but there are also overlapping market hours. These overlapping periods are perfect for trading because the market tends to have high liquidity and increased volatility, which can lead to greater profit opportunities. However, the risk also increases during these times.

Trading during market off-hours

The question is, what happens if we trade when the market is still closed? The answer is that we can still trade normally. However, the downside is that price movements in the market will slow down because there is a lower trading volume. Trading during this time can lead to paying higher spreads more easily and more frequently.

Sometimes, the spread during the time when the market is still closed can be lower than during peak market hours. This is because the prices are not highly volatile yet, so liquidity providers do not need to widen the spreads to cover the risks from volatility.

But there are also advantages. During the time when the market is still closed or when market movements are low, we can plan our trades. This allows us to analyze trends and price movement patterns more easily without severe fluctuations. It also helps reduce stress caused by trading in highly volatile markets and lessens the pressure from high volatility, enabling traders to focus better on analysis and decision-making.

The market opens early in the morning and closes in the evening.

Regarding the market opening early Monday morning at 5:00 AM and closing late Friday night into Saturday at 4:00 AM, including the daily server maintenance from 4:15 AM to 5:00 AM, we should clear any open orders before the market closes to avoid swap fees charged for holding orders overnight.

There is also a time when traders and investors like to trade, which is during the release of economic data or news announcements. During these times, currency values can be highly volatile and move sharply. If you trade at the right moment, there is a high chance of making a profit. However, if you enter at the wrong time, there is also a high risk of losing your capital.

Conclusion

Trading during market hours can increase opportunities for traders like us to learn and improve our trading skills, due to the need to respond to market changes and make quick decisions in a highly volatile environment.

Choosing the right time to trade is very important. If we select periods with high liquidity and high volatility, we will have greater opportunities to make profits. However, we should always be cautious and plan our trades carefully to manage the risks that can occur at any time in the constantly uncertain foreign exchange market.